CHART OF THE WEEK 📈

In startup investing, evaluating a company's founders is a key step in the due diligence process. And an easy thing to look for is whether a founder has had previous startup experience or not.

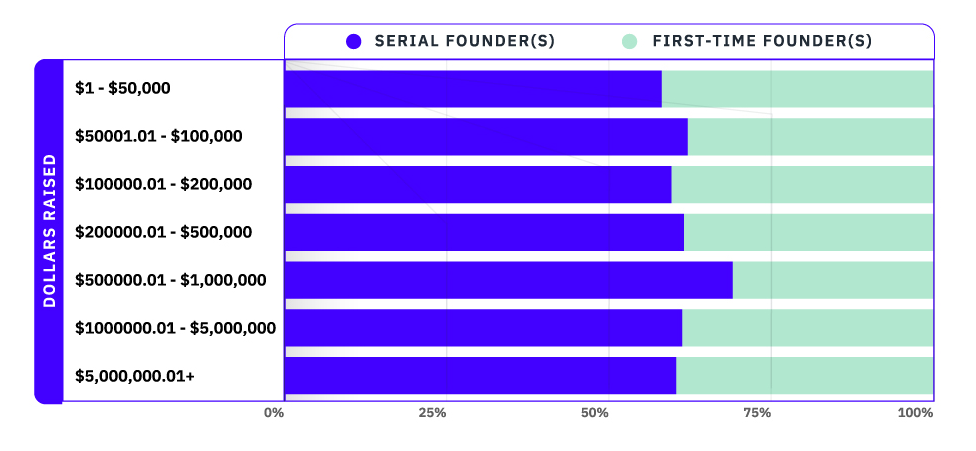

In 2022, there were more teams with previous startup experience than teams of first-time founders. But retail investors funded teams with serial entrepreneurs only slightly more than first-time founders.

Serial founders were most successful in the $500,000 to $1 million range, grabbing nearly 70% of investor activity there.

It's possible that retail investors are prioritizing a company's concept and performance over its founders' past experience. And there's little to indicate that simply having past startup experience gives founders a substantial edge.

To learn more about the funding split between first-time and serial founders in 2022, see our full analysis HERE.

STAFF PICK 🌶

The most common source of energy storage is lithium-ion batteries. They are the cheapest solution available for renewable energy farms, and they store electricity instantaneously. But they have some major drawbacks.

Lithium mining isn’t green, which sort of defeats the purpose of using lithium batteries for renewable energy. Every ton of lithium mined releases as much as 15 tons of carbon dioxide into the atmosphere. And lithium batteries can’t provide the kind of storage that renewables really need. They can hold only about four to six hours of energy, which is nowhere near enough to power the grid. And lithium-ion batteries designed to last longer would be too expensive to be practical.

Lithium batteries also have a short lifespan. After 2,000 charge cycles — usually around five years — their storage capacity falls below 80%, so most renewable energy farms need to replace them regularly. This increases their cost over time and multiplies their environmental impact. And lithium batteries are very hard to recycle and release toxic chemicals when they sit in landfills. From start to finish, lithium batteries are far from an ideal solution.

There are existing solutions that actually have a lower environmental impact and a longer lifespan. But none are competitive in terms of price. This is the problem that Qnetic is trying to solve — providing affordable and sustainable energy storage that can power cities from evening peak hours to the next sunrise

Qnetic is a Neutral Deal on KingsCrowd. Read our full Analyst Report to learn more.

Join 10,000 investors using Edge to access the best deals and the best data available to the online private market.

Sign up with coupon code MEMO for 30 days of free access to Edge!

TOP DEALS 💸

Otherweb uses artificial intelligence to filter out clickbait and fake news on the internet, allowing users to access more trustworthy information. It boasts a community of 93,000 active users.

Valuation: $8 million

Platform: Wefunder

Minimum Investment: $100

Flower Turbines creates a variety of sleek wind turbines that can fit in tight spaces and work better when packed closely together. Its turbines are currently being used for sustainable battery recharging at Coldplay concerts.

Valuation: $124.6 million

Platform: StartEngine

Minimum Investment: $600

Atsign has developed an open-source technology platform that makes Internet of Things devices more secure. In 2022, the company received an award from the IoT Security Foundation.

Valuation: $35 million

Platform: Republic

Minimum Investment: $150

Click HERE to see our complete list of deals…

Term of the Week 🤓

Debt crowdfunding: Debt crowdfunding is when a company -- usually a small business -- agrees to accept a loan funded by multiple investors online. The company must repay the loan (plus interest) to investors over a set period of time. The minimum investment in these loans are typically small, so a company needs several investors to raise the money it needs (that’s the crowdfunding part). Debt crowdfunding can also be referred to as debt financing or a debt round.